Pitfalls in Risk Attribution by Ben Davis, Jose Menchero.

MSCI helps managers navigate the unparalleled transformation the financial industry is facing today through our world-class research in Multiple Asset Classes, Factors and ESG Investing. Our world-class research, analytics and indexes help you make better investment decisions by providing the tools and solutions that you need to navigate.The New York office is MSCI's Global Headquarters. It is located in downtown Manhattan, next to the World Trade Center memorial site. The office is also home to our CEO and several of our Executive Committee members. Explore opportunities in New York.MSCI Barra Research Paper No. 2008-04. 6 Pages Posted: 24 Jan 2009. See all articles by MSCI Inc. MSCI Inc. MSCI Inc. Date Written: December 2008. Abstract. This is the third of a series of Research Bulletins to mark the launch of the new and enhanced Barra Global Equity Model (GEM2), and its focus is on the newly-introduced liquidity factor. This factor reflects the stock performance of firms.

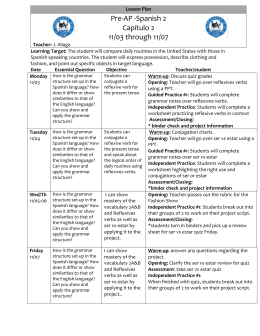

MSCI Barra Research Paper No. 2011-07. 15 Pages Posted: 27 Apr 2011. See all articles by Ben Davis Ben Davis. MSCI Inc. Jose Menchero. MSCI Barra. Date Written: February 16, 2011. Abstract. While performance analysis is typically conducted on a benchmark-relative basis, risk analysis is often presented on an absolute-return basis. This mismatch between sources of risk and return leads to the.Have your msci barra research paper paper edited by your writer as many times as you need, until it’s perfect. Stars. Discipline: History. They treated me so well, answered all my questions and wrote the hard parts for me. My writer was a retired English teacher!

New groundbreaking research from MSCI solves this dilemma by demonstrating that it is not only possible to backtest Expected Shortfall, but that the methodology MSCI has created is a more.